Dublin, June 24, 2024 (GLOBE NEWSWIRE) — The “APAC Data Center Market Landscape 2024-2029” report has been added to ResearchAndMarkets.com’s The offer of

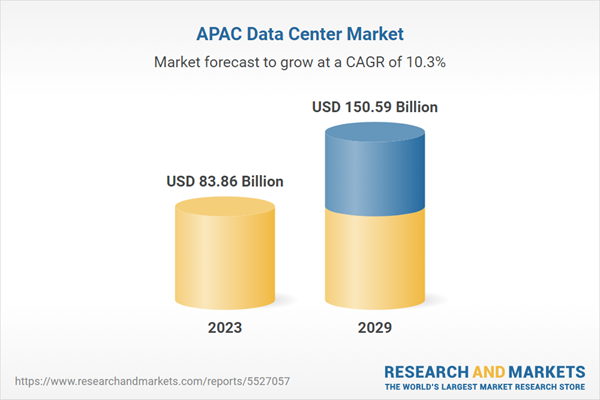

The APAC Data Center market was valued at USD 83.86 billion in 2023 and is expected to reach USD 150.59 billion by 2029, growing at a CAGR of 10.25%.

The APAC data center market hosts several local and global IT infrastructure vendors such as Hewlett Packard Enterprise, IBM, Atos, Cisco Systems, Dell Technologies, Arista Networks, Juniper Networks and others. Vendors are constantly investing in innovation in their offerings to meet market demand.

The APAC data center market is one of the major growing data center markets globally, with higher investment contribution from countries such as Australia, India, China and Japan, with other countries such as South Korea, Taiwan, Hong Kong and New Zealand. with steadily increasing data center activities.

Malaysia and Indonesia have emerged as the key growth markets in the APAC data center market following a setback in Singapore due to a moratorium passed on data center construction. Investment in Singapore is expected to increase again after the government announced a pilot project to build data centers.

Other countries, such as the Philippines, Vietnam and Thailand, are experiencing a sudden increase in demand, especially from the spread of demand from Singapore after the moratorium. Countries such as Vietnam and the Philippines are among the markets expected to witness an increase in the growth rate in the coming years.

The APAC data center market has many local and global backend infrastructure vendors, which has increased its competitiveness. Some key vendors in the APAC data center market include ABB, Caterpillar, Cummins, Eaton, Rittal, STULZ, Schneider Electric, Vertiv and others. Global general construction contractors such as AECOM, Arup, CSF Group, DSCO Group, NTT Facilities, RED and others have increased the speed of construction and the availability of a skilled workforce has become easier through multiple organizations.

MAIN TRENDS

The rise of digitization is driving the growth of data centers in the APAC region

The APAC data center market is experiencing expansion, fueled by the widespread digital transformation across the region. The growing trend of digitization is driving a rapid increase in demand for data centers, with various regions implementing their own digital strategies.

The rapid adoption of digital technologies in the region is driven by a growing demand for improved productivity, optimized resource utilization and various other advantages. The expansion of 5G connectivity, coupled with the use of Big Data and IoT services, further contributes to the ongoing digitization trend in the area.

China’s national development strategy consistently favors the digital economy. In line with the 14th Five-Year Plan, China seeks to increase expertise in critical areas, including quantum information, communications, integrated circuits, sensors and blockchain. In addition, it actively promotes emerging technologies such as 6G.

The Indian government launched the Digital India programme, which involves many government departments and aims to nurture a future of learning and development for India.

Edge data center deployment driven by increased 5G network connectivity

Adoption of 5G technology is widespread in various countries, including China, Australia, Japan, Singapore and South Korea. The deployment of 5G in multiple locations is driven by the need for high computing power and improved connectivity standards within data centers.

Some major operators in Hong Kong are China Mobile Hong Kong Ltd, Hong Kong Ltd, SmarTone Mobile Communications Ltd and Hutchison Telephone Company Ltd.

The government has uniquely agreed with New Zealand’s three main network providers – Spark, 2Degrees and One New Zealand. This agreement aims to accelerate the deployment of 5G services in approximately 55 rural and regional towns across the country, extending mobile wireless coverage to other remote areas that currently do not have adequate service.

Growing adoption of artificial intelligence driving demand for efficient infrastructure

The deployment of edge data centers is driven by growing 5G network connectivity. Adoption of 5G technology is widespread in various countries, including China, Australia, Japan, Singapore and South Korea. The deployment of 5G in multiple locations is driven by the need for high computing power and improved connectivity standards within data centers.

SEGMENTATION INSIGHTS

- Servers are available in different types and configurations. In terms of form factors, servers are classified as rack, blade and tower. The most common servers in the APAC data center market include rack and blade servers from vendors such as Cisco Systems, Hewlett Packard Enterprise, Dell Technologies, IBM, Lenovo and NetApp.

- Vendors have an increasing opportunity to provide lithium-ion and nickel-zinc batteries for UPS systems. Operators can also adopt new age generator sets that run on hydrotreated vegetable oil (HVO), natural gas, etc.

- The APAC data center market is witnessing the adoption of air-based and water-based cooling systems, followed by water-based cooling solutions, which are in high demand due to the region’s tropical climate.

ANSWERS TO KEY QUESTIONS

- How big is the APAC data center market?

- What is the growth rate of APAC Data Center market?

- What are the key trends in the APAC data center industry?

- What is the estimated market size in terms of area in the APAC data center market by 2029?

- How many MW of power capacity is expected to reach the APAC data center market by 2029?

Main attributes:

| The report attribute | The details |

| No. of Pages | 88 |

| Forecast period | 2023 – 2029 |

| Estimated market value (USD) in 2023 | 83.86 billion dollars |

| Estimated market value (USD) by 2029 | 150.59 billion dollars |

| Compound Annual Growth Rate | 10.2% |

| Regions covered | Asia Pacific |

LANDSCAPE FOR SALE

YOUR INFRASTRUCTURE PROVIDERS

- Arista Networks

- Atos

- Cisco Systems

- Dell Technologies

- Broadcom

- Extreme networks

- Fujitsu

- Hewlett Packard Enterprise

- Hitachi Vantara

- Huawei

- IBM

- Inspur

- Intel

- Juniper Networks

- Lenovo

- Micron Technology

- NEC

- NetApp

- The burden

- Clean storage

- Quanta Cloud Technology

- QNAP

- Quantum

- Seagate Technology

- Super Micro Computer

- Toshiba

- Western Digital

- Wiwynn

Prominent building contractors

- AECOM

- Arup

- Aurecon Group

- The CSF group

- The DSCO group

- Gammon Construction

- Larsen & Toubro (L&T)

- NTT facilities

- KM group

- Studio One Design

Other prominent building contractors

- AWP Architects

- BYME Engineer

- Chung Hing Group of Engineers

- Corgan

- CTCI

- DPR construction

- Fortis Construction

- Hutchinson Builders

- ISG

- Kient Engineering Construction

- Line of sight

- LSK Engineering

- The M+W group

- Nakano Corporation

- The Obayashi Corporation

- Power Systems (PWS)

- Sato Kogyo

- Sterling and Wilson

- Network Engineering

- Knight Levett Bucknall

- Turner & Townsend

Prominent backend infrastructure vendors

- ABB

- caterpillar

- Cummins

- Eaton

- Rittal

- Schneider Electric

- MAKING

- Vertiv

Other prominent backend infrastructure vendors

- Airedale

- Alfa Laval

- Canovat

- Cyber power systems

- Delta Electronics

- EA

- Fuji Electric

- Green Revolution Cooling (GRC)

- HITEC power protection

- KOHLER Power

- Legrand

- Mitsubishi Electric

- Narada

- Piller Energy Systems

- Rolls Royce

- Shenzhen Envicool Technology

- Siemens-operated

- Socomec

- Train

Prominent data center investors

- Alibaba Group

- AirTrunk

- Amazon Online Services

- China Unicom

- China Mobile

- Chindata Group

- Digital Realty

- Equinix

- GDS Services

- Keppel Data Centers

- Microsoft

- NTT Global Data Centers

- NEXTDC

- Global Data Centers ST Telemedia

Other notable data center investors

- AdaniConneX

- BDX

- CDC Data Centers

- Chayora

- Colt Data Center Services

- CtrlS Data Centers

- Digital Edge DC

- Edge centers

- EdgeConneX

- Meta

- Haoyun Changsheng

- Huawei Technologies

- Iron Mountain

- LG Uplus

- MettaDC

- Excerpt from Airtel

- OneAsia Network

- Open DC

- Princeton Digital Group

- Pure Data Centers Group

- SpaceDC

- Shanghai Atrium (AtHub)

- STACK infrastructure

- SUNeVison Holdings

- Sify Technologies

- Tencent

- Tenglong Holding Group

- Vantage Data Centers

- Viettel IDC

- VNET

- Yotta Infrastructure Solutions

- YTL Data Center

New entrants

- Digital room

- Empirion DC

- Evolution Data Centers

- GreenSquareDC

- Gaw Capital

- Infracrowd Capital

- K2 Data Centers

- Minor Energi Indonesia

- Nautilus Data Technologies

- SC Zeus Data Centers

- Regal Orion

- YCO Cloud

- Yondr

PREMIUM VIEWS

Investment Opportunities

- Investing: Sizing and Forecasting the Market

- Area: Market size and forecast

- Energy Capacity: Market Size and Forecast

Market Dynamics

- Market Opportunities and Trends

- Market growth enablers

- Market restrictions

- Country selection criteria

MARKET SEGMENTATION

Segmentation by object type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

Segmentation by Infrastructure

- IT infrastructure

- Electrical infrastructure

- Mechanical Infrastructure

- General Construction

Segmentation by IT Infrastructure

- Server Infrastructure

- Storage infrastructure

- Network infrastructure

Segmentation by Electrical Infrastructure

- UPS systems

- Generators

- Keys and transfer equipment

- Energy Distribution Units

- Other electrical infrastructure

Segmentation by Mechanical Infrastructure

- Cooling Systems

- shelves

- Other mechanical infrastructure

Segmentation by cooling systems

- CRAC & CRAH units

- Refrigerant units

- Cooling towers, condensers and dry coolers

- Economizer and evaporative cooler

- Other cooling units

Segmentation by cooling techniques

Segmentation by General Construction

- Core & Shell Development

- Installation and commissioning services

- Engineering and Building Design

- Physical security

- Fire detection and extinguishing

- DCIM

Segmentation by level standard

- Level I & II

- Level III

- Level IV

For more information about this report, visit https://www.researchandmarkets.com/r/8ncna0

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, leading companies, new products and the latest trends.

#APAC #Data #Center #Market #Landscape #HPE #IBM #Atos #Cisco #Systems #Dell #Technologies #Arista #Networks #Juniper #Networks #Dominating #Billion #Industry

Image Source : www.globenewswire.com