All of these Treasury securities have been sold. So here are the keepers.

By Wolf Richter for WOLF STREET.

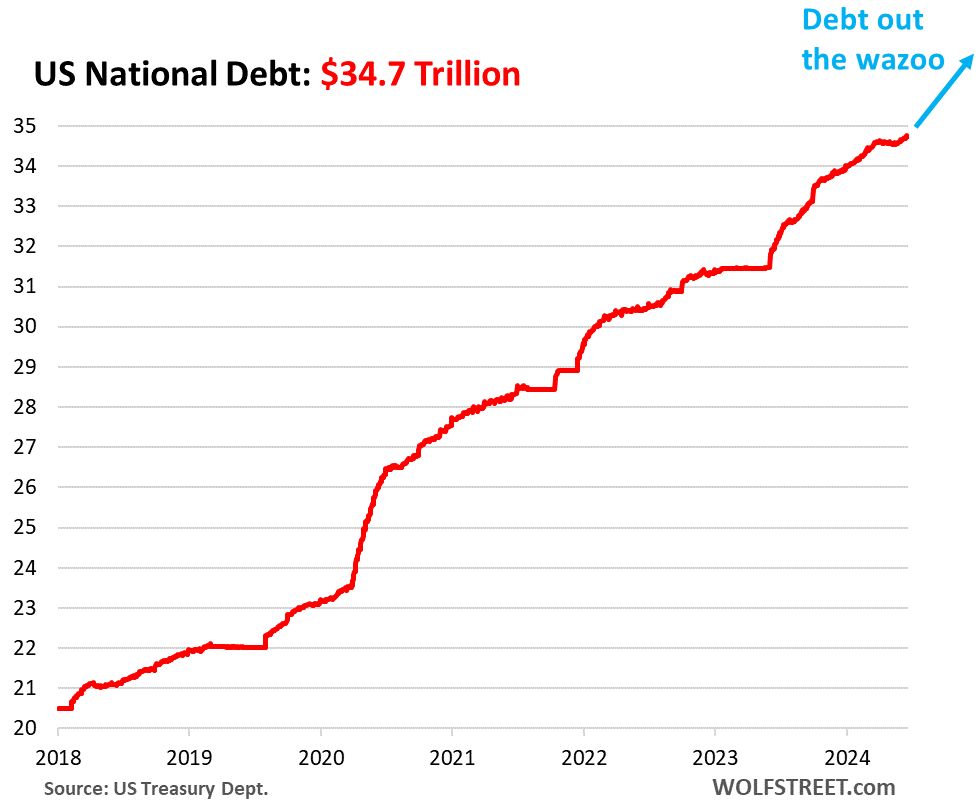

The US national debt – now $34.7 trillion, up from $23.3 trillion in January 2020 and up from $27.6 trillion in January 2021 – has grown so fast it would make us tear up with disbelief if we didn’t know better. Over the four years and five months since January 2020, it has grown by $11.4 trillion. Since the end of the pandemic, the economy has grown rapidly, yet the trillions were flying so fast that it is difficult to see them. We don’t even want to imagine what this will look like during the next recession.

But every single one of the Treasury securities the government issued was bought, and we’ll get to the holders in a moment:

Who owns the $34.7 trillion debt?

Each of these Treasury securities is held by an entity or individual. So here they are.

US government funds: $7.1 trillion. Held by various US government pension funds and the Social Security Trust Fund (we discussed SS Trust Fund holdings, income and outflows here). These treasury securities are not traded in the market, but are purchased directly from the funds of the Treasury Department and at maturity are redeemed at nominal value. They are called “held in” and are not subject to the whims of the markets.

The remainder amounts to $27.6 trillion currently, which are “publicly held” securities.

A small portion of this $27.6 trillion in securities cannot be traded, such as savings bonds (including popular I bonds) and some other bond issues.

The rest are Treasury bills, notes and bonds, plus Treasury Inflation-Protected Securities (TIPS) and Floating Rate Notes (FRNs). These securities are traded (“marketable”). At the end of the first quarter – that’s the timeframe we see below), there was $26.9 trillion of these securities outstanding.

Foreign holders: $8.0 trillion. Includes private sector holdings and official holdings, such as from central banks. China, Brazil and other countries have been reducing their holdings for years. European countries, major financial centers, Canada, India and other countries are loaded. In total, foreign holdings rose to an all-time high in March and eased slightly in April, which was still the second highest ever. While total foreign holders have increased their holdings in dollar terms over the years, their share of total outstanding debt has declined from 33% a decade ago to 22.9% now because they have not kept up with the rapid growth. of US debt. (We have discussed the details of those foreign holders here).

The remainder is in the hands of the US Holders.

The Securities and Financial Markets Industry Association (SIFMA) just released its quarterly fixed income report for the first quarter. It does not describe dollar amounts, but the percentage of Treasuries, notes, bonds, TIPS and FRNs outstanding. As of March, there were $26.9 trillion of these Treasuries in circulation. And they were kept by:

American mutual funds: 18.0% of treasury securities in circulation (about 4.8 trillion dollars). They include bond mutual funds that hold Treasury securities and Treasury bond holdings in money market mutual funds.

Federal Reserve: 16.9% of treasury securities in circulation (about 4.6 trillion dollars in March). Under its QT program, the Fed has already removed $1.31 trillion of Treasuries since the peak in June 2022 (our last Fed QT update).

US individuals: 9.8% of treasury securities in circulation (about 2.6 trillion dollars). These are people who keep them in their US accounts.

Banks: 8.1% of treasury securities in circulation (about 2.2 trillion dollars). We saw in March 2023, banks holding a lot of long-term Treasuries and MBS that lost a lot of market value because of the rise in yields, and as depositors saw that and got scared and pulled their money out, some banks were collapsed. According to FDIC data, the total amount of all types of securities held by banks — Treasuries, MBS and other securities — was $5.5 trillion at the end of the first quarter, with cumulative losses of unrealized on all their securities that rose to $517 billion. $2.2 trillion is just Treasury securities.

State and local governments: 6.3% of treasury securities in circulation (about 1.7 trillion dollars).

Pension funds: 4.3% of treasury securities in circulation (about 1.2 trillion dollars).

Insurance companies: 1.9% of treasury securities in circulation (about 510 billion dollars). Warren Buffett’s insurance conglomerate, Berkshire Hathaway, has increased its Treasury bond holdings to $153 billion.

Other: 1.5% of treasury securities in circulation (about 400 billion dollars).

This shows how far and wide Treasury securities are spread. If these investors lose interest in current yields and demand for current yields disappears, yields must rise until sufficient demand materializes. And that can happen quite suddenly, which is what we saw happen when the 10-year yield briefly pierced 5% in October, unleashing a flood of demand that drove prices up, and so yields fell again. Currently, amid increased demand, the 10-year yield has returned to 4.25%, even though Treasury bond yields are close to 5.5%.

To what extent are interest payments eating into national income and how long can this continue? See… High Interest Payments on Growing US Government Debt v. Tax Receipts and Inflation: First Quarter Update

Love reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug of beer and iced tea to find out how:

Want to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

#holding #recklessly #inflated #trillion #national #debt

Image Source : wolfstreet.com